"If you're contributing 10% of your $4,000 monthly gross pay to your 401(k), that's $400 in retirement savings in one account, without any ongoing action required on your part." "This strategy will force you to stay disciplined," Schrage said. These types of accounts automatically deduct a specified pre-tax amount from your paycheck each pay period. (If there's no 401(k) at your workplace then open your own IRA as a retirement savings vehicle.) Tap the "free money" in your employer's 401(k) savings planĪndrew Schrage, co-founder of Money Crashers Personal Finance, recommends making the savings process as "turnkey" as possible by automatically contributing to employer-sponsored 401(k) plans, which are offered by most companies. "If you wait until you're in your 40s, you lose all that time and money you would have earned from compound interest." 3. "Consolidate as much as possible so you can save and make the most of your money, because the earlier you save the more compound interest you will earn," said Ash Exantus, director of financial education and financial empowerment coach at BankMobile. The 50-30-20 ratio, popularized by Senator Elizabeth Warren in her book "All Your Worth: The Ultimate Lifetime Money Plan," is the classic approach. To protect against spending beyond your means, lay out all of your expenses and determine how much to allow yourself to drop into each major spending category.

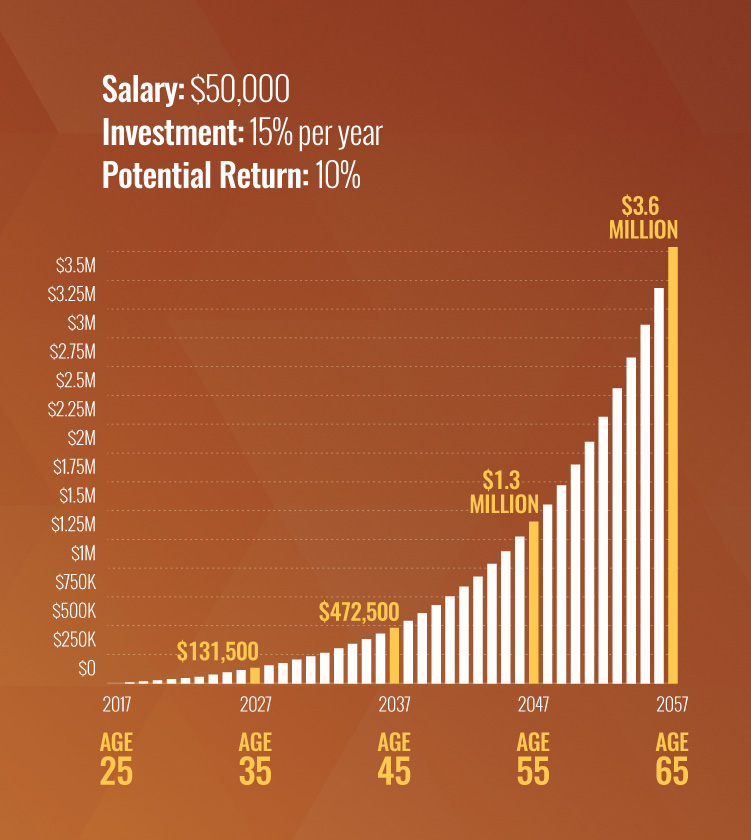

But experts say starting to set aside money and developing good savings and investing habits early is the key to financial success in your 60s and 70s. Retirement might seem like too distant a milestone to prioritize in your 20s and 30s, what with tight budgets and juggling expenses like rent, student loan repayments and discretionary spending.

Because time is on your side when it comes to compounding interest, the earlier you start saving, the better off you'll be decades down the line. There's no time like the present to start planning for retirement, especially if you're a millennial.

0 kommentar(er)

0 kommentar(er)